What Do I Need to Know Before Starting Crypto Trading?

Who Are the Crypto Traders?

In simple words, crypto traders are individuals who actively participate in the exciting and ever-evolving world of cryptocurrency markets. These revolve around the buying, selling, and exchanging of different virtual or digital currencies, also known as cryptocurrencies (Bitcoin, Ethereum, etc.). These digital assets are built on blockchain technology, a decentralized and secure ledger that ensures transparency and immutability.

The traders join the crypto market with the primary goal of making profits. They analyze the price movements and trends of various cryptocurrencies and seek opportunities to capitalize on price fluctuations. Someone does it as a hobby, while others treat it as a full-time profession.

Short-Term vs. Long-Term Trading

Within the realm of trading crypto, two main approaches stand out: short and long term.

The first one implies instant gains. It involves more frequent buying and selling of assets within relatively compressed timeframes (several hours or even minutes). This approach allows one to react faster to market movements and changes. Thus, the losses are decreased.

Traders following the second approach purchase the coin at the cheapest value. Then they hold it, irrespective of the short-term price fluctuations and market noise. The coin is only sold when it’s at its peak. So, in short, they always seek long-run gains.

Main Types of Crypto Traders

However, the ultimate aim is often financial gain, and traders employ diverse strategies to achieve their objectives. It leads to different types of them in the crypto space. Below, we’ve listed the most known ones.

- Day traders buy and sell cryptocurrencies within the same day, aiming to capitalize on short-term price movements. They closely monitor the landscape and trends and make multiple trades throughout the most active hours of the day.

- Swing traders are grounded and hold onto cryptocurrencies for a few days to several weeks. Relying on technical analysis, they watch the past and current state of the asset market to identify future prices.

- Scalpers are some of the most impatient and make numerous rapid crypto trades throughout the day, aiming for an assured profit. They focus on monitoring and learning from the influence of every market shift. They also know how to make sound decisions under pressure.

- Copy traders are mostly newbies who replicate the strategies of pros. They locate successful ones with a record of profitable trading and copy their actions in the hope of achieving similar progress.

- HODLers, known as “diamond hands,” are long-term investors who believe in the potential of digital assets over an extended period. They hold onto them through market ups and downs.

- Bull traders seek to invest in assets rising in value but buy only when these are in a fixed leading position. They have a positive outlook on the market’s growth potential and often engage for the long term.

- Bear traders, the full opposite of the bull category, adopt a more cautious view of the market. They analyze several factors to predict its future, use the denial phase, and offload everything before it takes a nosedive.

With a clear picture of these different types, you now understand the various approaches within the community. It’ll help you identify your own trading style that aligns with your risk tolerance, time availability, and financial goals.

Understanding a Cryptocurrency Exchange

Crypto exchanges play a crucial role in enabling liquidity, price discovery, and accessibility within the market. At these marketplaces, you can create an account and make different order types to purchase or sell crypto. These platforms may include different valuable features, such as:

- futures trading;

- margin accounts;

- crypto staking,

- crypto loans, etc.

Crypto exchanges also provide various tools, charts, and educational resources to help you stay up-to-date and make more informed decisions.

It’s important to mention that when you participate in trading at a crypto exchange, you pay withdrawal and trading fees. The first one means charging when you withdraw coins. Trading fees imply that a flat percentage of the amount of cryptocurrency you purchase or sell is charged.

The percentage of trading fees may differ depending on whether the orders are makers (add liquidity to a crypto exchange) or takers (remove it by completing orders that wait for a trade). Usually, maker fees are a bit less than those of takers. However, considering that you can’t choose whether your orders will be processed as takers or makers, it’s best to look at overall fees.

CEX and DEX Exchanges

CEX and DEX are the two main types of crypto exchanges.

CEXs are centralized exchanges. One entity is in charge of managing them. Examples include Binance and Coinbase. Here, you can convert fiat currencies into crypto. This type of cryptocurrency exchange may require you to provide personalized info. Still, most have strong security measures in place (e.g., storing assets offline, taking out insurance policies) to protect it.

DEXs are decentralized exchanges. These operate without a central intermediary, distributing the responsibility for facilitating and verifying trades among users. Examples include Uniswap and PancakeSwap. Oftentimes, these platforms aren’t very user-friendly regarding currency conversion and may have lower liquidity and fewer trading options.

Is Crypto Trading Legal?

The growing acceptance and interest in cryptocurrency have fostered the adoption of regulations around the world to govern it and address associated concerns. These rules aim to provide a balance between promoting innovation and protecting investors and consumers.

At present, the legality of crypto trading varies from country to country. Some have embraced a proactive stance, recognizing the potential benefits of blockchain technology and cryptocurrencies. They have implemented clear frameworks to control this activity, promoting responsible practices and investor safety.

Generally, wherever crypto trading is legal, it’s subject to AML (anti-money laundering) regulations and taxation. The last one differs from place to place: in the USA, crypto is taxed as property, but in several EU countries, it’s taxed as income. Nevertheless, other nations have chosen to outright ban or heavily restrict certain cryptocurrency activities due to concerns about financial stability and the potential for illicit activities.

Knowing the legal status of cryptocurrency trading is important for crypto users to have a safe and transparent trading experience. Ignoring or unknowingly violating regulations can lead to legal repercussions and financial losses. You may consider consulting legal pros to gain a clear picture of the legal landscape in your region.

Do You Need a License to Trade?

A crypto license is a regulatory document issued by government agencies (like FinCEN in the U.S.) that allows businesses in that sphere to operate legally. Therefore, for individual fx-crypto traders looking to buy and sell coins, obtaining a specific trading license is generally not required.

On the other hand, businesses dealing in crypto, such as platforms facilitating trading or exchanges, should be subject to licensing and regulatory compliance. That’s because they are involved in a highly regulated area—money transmission. So, if you purchase or sell digital assets as a part of a commercial enterprise or business, you may need this document too.

How to Start a Crypto Trading Career

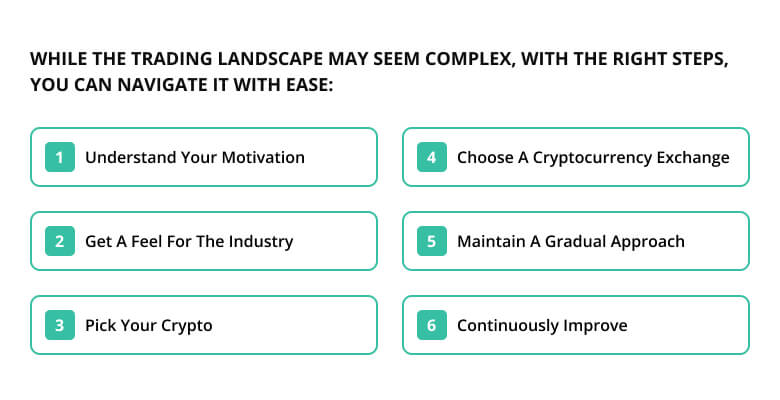

Already wondering how to begin your career as a crypto trader? While the trading landscape may seem complex, with the right steps, you can navigate it with ease.

- Understand Your Motivation: Before diving into the activity, understand why you want to start trading. Is it for financial gain, interest in technology, or just curiosity? Evaluate your individual risk appetite and investment objectives, too. These details will guide your further actions and help you stay focused on your journey.

- Get a Feel for the Industry: Familiarize yourself with the fundamentals, like trading volume, private keys, and blockchain technology. Learn more about its consensus protocols (proof-of-work and proof-of-stake). Grasp the difference between hot (more vulnerable but convenient for regular use) and cold (more secure but less suitable for frequent trading) wallets.

- Pick Your Crypto: Explore different types of cryptocurrencies and their peculiarities. With thousands of options available, it’s important to conduct thorough research and look beyond the biggest names.

- Choose a Cryptocurrency Exchange: Determine choices that align with your goals and risk tolerance. Select one that’s reliable, offers a user-friendly interface, security features, and a variety of trading pairs.

- Maintain a Gradual Approach: Don’t rush. Craft a strategy based on technical and fundamental analysis, set entry and exit points, and establish risk management rules. Start small, practice with demo accounts, and gradually increase your trading volume as you gain more confidence.

- Continuously Improve: The crypto industry is constantly evolving, so continuously expanding your knowledge is key. Stay informed with industry news, trends, and technological developments.

Now you’re packed with the course of action to get started on your exciting trading journey. Remember, it requires dedication and a willingness to learn and adapt. Over time, you’ll gain experience and refine your skills.

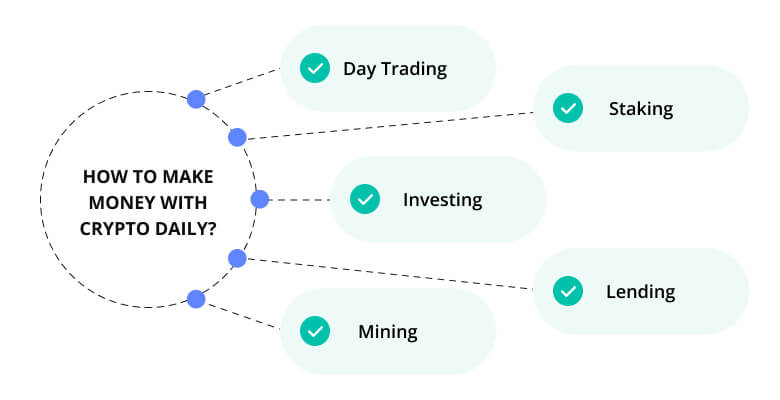

How to Make Money with Crypto Daily

The diversity of ways to earn from cryptocurrencies daily opens up many possibilities. Let’s delve into some trading strategies you can employ.

Day Trading

This strategy involves buying cryptocurrencies at one price and selling them at a higher price within a single day. The goal is to profit from short-term price fluctuations. However, day trading requires constant monitoring, the ability to react swiftly, and emotional discipline.

Investing

Investing is about buying a digital currency with the expectation that its value will increase over time. It’s for those aiming for long-term profits.

You may purchase a cryptocurrency index fund or buy individual coins. It’s a great way to diversify the portfolio while spreading the risk.

Staking

This method entails holding certain cryptocurrencies in a wallet for a set period of time. That way, you support the operations of a blockchain network. In return, you can earn rewards and generate passive income. The amount depends on the virtual currency and the number of coins staked.

Lending

This approach implies that you lend your cryptocurrencies to others in return for interest. The interest rate is defined by the amount and type of digital currency you lend. Although there’s a risk of borrower default, crypto lending can be considered a source of passive income.

Mining

It can be done with cloud services or specialized hardware. The first method typically generates a lower profit, but you don’t need to buy equipment. In any case, miners help release new coins into circulation; that’s what the reward comes for.

Best Forex Affiliate Programs in 2023

The Forex market keeps booming in popularity, and affiliate programs are an excellent way to get involved in this dynamic space. That’s because you can generate passive profits without trading or investing.

The concept is simple: once you sign up on a broker affiliate platform, you get a unique affiliate link to share. If someone clicks on it, registers, and makes a deposit, you’ll earn a commission.

Below, we’ll share some of the best FX affiliate programs to consider.

- Vantage offers two partner programs: IB (Introducing Broker) and CPA. IB rebates are volume-based and paid after a referral closes a trade. For CPAs, commissions depend on the country and range from $100 to $600, plus a monthly bonus.

- FXPro has a two-tier program. It pays you a commission on the trades of your referred clients and their referrals. Customized partnership schemes can be discussed individually. The platform promises to give up to 55% of its revenue from every active trader.

- XM has IB (Introducers of Business) and Web Affiliates (for website owners) programs. They propose up to $25 per lot on referrals and 10% on 2nd tier referrals. Bespoke solutions can also be discussed.

- Eightcap delivers one of the most attractive and competitive commission models, giving a $6 rebate per lot plus revenue share. Programs include IB and standard affiliate partnerships.

You may also become familiar with other noteworthy brokerage affiliate platforms like Adscobar, Olavivo, and IronFX.

Who Are the Best Crypto Traders?

One way to become a successful crypto trader is to learn from the experience and expertise of pros. That’s why we’ve curated this list of the most notable and influential figures, so you can pick up the best crypto traders and follow them up.

- Chris Larsen: A co-founder of Ripple, he has been listed as one of the richest crypto traders in the world. His background in fintech and his role in co-founding Ripple, known for its XRP token and blockchain solutions, have positioned him as a prominent player in the cryptocurrency ecosystem.

- Tyler and Cameron Winklevoss are known for their lawsuit against Facebook’s CEO, which they won and invested in Bitcoin. Tyler is the founder of Winklevoss Capital Management. Both brothers are co-founders of HarvardConnection and cryptocurrency exchange Gemini. According to estimations, they hold crypto worth $1.4bn apiece.

- Tone Vays, a former Wall Street Risk Analyst turned crypto consultant and derivatives trader, has gained recognition for his educational materials on the importance of Bitcoin and Blockchain. His expertise in evaluating market trends and sharing his views has made him a prominent figure in the crypto community.

- Nicholas Merten, known as “DataDash,” is a crypto analyst and independent content creator. He talks about the fundamentals, provides smart trading advice, and discusses the technical side of trading cryptocurrencies.

These individuals have not merely mastered the complex market landscape. They’ve shown that success in crypto trading requires a commitment to education, innovation, and contributing positively to the crypto community.

Who Gives Good Crypto Advice?

In the crypto trading world, volatility is the norm, and the potential for gains is as thrilling as it is uncertain. Yet, this fascinating industry offers diverse avenues for profit, whether you’re seeking short-term results or long-term stability.

Remember, every successful crypto trader started from scratch. And with ForexSEO, you’re now equipped with the essential knowledge to turn the tide in your favor and start trading confidently.

FAQ:

Is Crypto Trading Hard?

Due to volatility and general industry complexity, trading cryptocurrency may appear challenging. It takes time and effort to understand market specifics and trends, perform technical analysis, and adopt risk management. However, it becomes manageable with consistent education, practice, and a patient approach. Devise your strategy, execute it with discipline, and you’ll gradually handle the intricacies and may become one of the top traders.

Can Beginners Trade Crypto?

Absolutely! While the learning curve may be steep, resources like courses and guides can help you get into the process. Get acquainted with the basics, educate yourself about the crypto market, and practice with demo accounts. As you gain confidence, start with a small investment, slowly increase it, focus on education, and practice risk management to become a successful crypto trader.

How Much Do Crypto Traders Make?

The question of what percentage of crypto traders make money and how much they make is a topic of much debate. It may be challenging to provide an exact percentage due to the inherent specifics of the industry. And the income of fx-crypto traders varies depending on skill level, strategy, and market conditions. According to the statistics, the average annual pay for a US trader is $94,266 per year.

Can I Make a Living as a Crypto Trader?

There are many stories of the most successful crypto traders who make a living from trading. However, if you’d like to be one of them, it’s crucial to recognize the risks.

Success requires expertise, emotional discipline, and the ability to adapt. But the volatile nature of the crypto markets means income can be inconsistent. So, it’s advisable to begin with a sustainable income source and gradually transition if consistent profitability is achieved.

Can I Hire Someone to Trade Crypto for Me?

You can hire a professional trader on dedicated platforms. Nevertheless, the risk that they might not deal with you honestly always exists. Therefore, do thorough research to ensure they’re reliable and have a good reputation. Remember, investment decisions should ultimately be made by you.

As an alternative, consider becoming a copy trader. Explore some of the best crypto traders to copy and follow their approach.